During over a decade as an estate planning attorney, I’ve noticed that one of the biggest reasons clients put off creating a living trust (or sometimes never get around to it at all) is simply because they’re confused. That’s tragic.

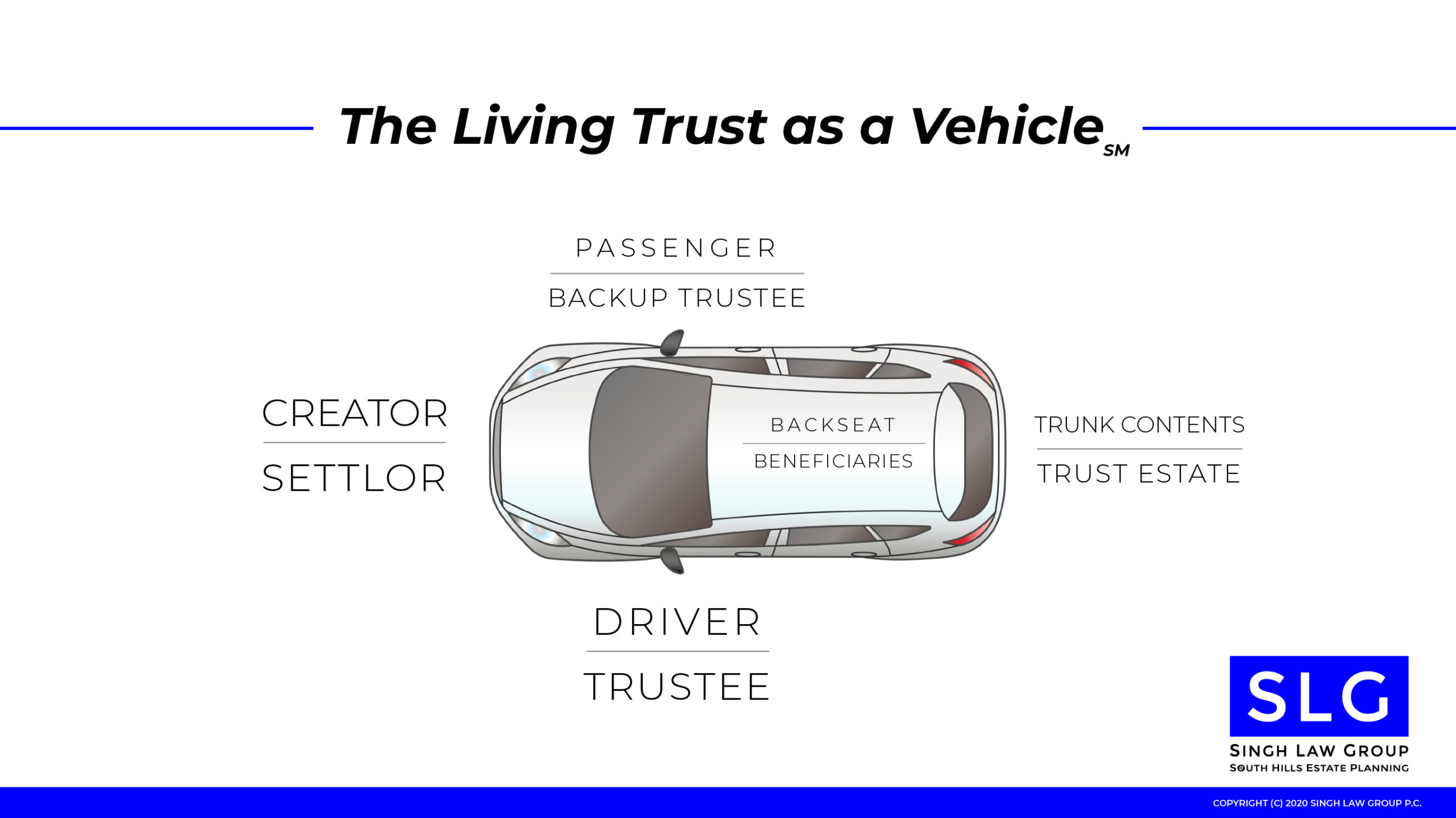

Legal jargon is confusing, for sure, but visuals allow us to get away from the terminology and focus on the big picture. The Living Trust as a Vehicle ℠ is an illustration I’ve used in consultations and speaking engagements, and it’s easily my most popular visual. Hopefully, it’ll resonate with you too.

Rules of the Road

Before we start, it’s important to have an understanding of the laws that apply to estate planning and estate administration. In California and New York, if someone passes away with real estate or other assets exceeding a certain minimal amount (small estate exemption), then there’s a risk that a probate court proceeding will be needed to administer the estate. I say risk because, depending on other factors, such as how the title to real estate or other assets are held, probate may not be necessary. But it could be necessary, and it often is.

At this point, clients will usually ask if a Will is sufficient to avoid probate. Unfortunately, it is not: estates without a Will (intestate) and estates with a Will (testate) are both required to be probated (assuming that a small estate exemption doesn’t apply).

This is a critical point, so I’ll repeat it: a Will alone does not avoid probate. In my own family’s case, my father only had a Will when he passed (he should have been advised by his attorney to create a living trust), and thus began our multi-year probate nightmare.

Using a Living Trust to Avoid Probate

So, how do you avoid probate? Is a living trust the only way? While there are various options to avoid probate, in my opinion (based on helping hundreds of families), a living trust is the most effective option for a few important reasons:

- It’s tax neutral with respect to income tax, property tax, and capital gains tax and preserves tax benefits (capital gain exclusions for primary residence) and step-up basis for inherited property.

- It comes into existence now, instead of upon death, so there’s a clear structure in place now that continues after you’re gone. It truly acts as a vehicle between you and the next generation.

- It’s flexible and adaptable to change. Living trusts are revocable, which means that they can be cancelled or modified at any time by the creators of the trust (as long as they have the capacity to do so). This is especially important if your children are minors – you want a plan that can grow and evolve with your family.

That said, I understand that the idea of creating a living trust sounds daunting. This is where The Living Trust as a Vehicle ℠ illustration can help, so here goes:

Manufacturer (Settlor/Grantor/Trustor)

Like the manufacturer of a vehicle, you design, build, and name your trust. And during your lifetime(s), you’ll continue to own the vehicle. In legal terms, we call you the Settlor(s), Grantor(s), or Trustor(s).

Trunk (Trust Estate)

It’s critical that we put your important things in the trunk of the vehicle so they get to the same destination. We place your house(s), your business(es), your bank account(s), and other important assets, including sentimental items like jewelry or heirlooms, in the trunk of your vehicle. Together, all of these assets are called the Trust Estate.

Driver (Trustee)

The driver controls the vehicle, but doesn’t own the vehicle. Typically, you (and your spouse) will be the first driver(s), or initial co-Trustee(s). The driver’s job (legal duty) is to get the vehicle to its destination safely.

Backup Driver (Successor Trustee)

Like a road trip, when you (and your spouse) can no longer drive, your passenger(s) can help with the driving duties. They are your backup driver(s), or Successor Trustee(s). Again, a driver simply has control of the vehicle, but not ownership.

Backseat (Beneficiaries)

The purpose of the vehicle is to get the occupants of the backseat, who are buckled in safely, to their destination. These occupants are typically children, but can also be non-profit organizations, or other important people, like family members or close friends. Together, we call them all beneficiaries. Ultimately, these are the people (or organizations) that we’re creating the vehicle for.

Road Map (Living Trust Document)

Now that we have a fully built and fully occupied vehicle with assets in the trunk, the question becomes: where are we going? The living trust document is a road map that stays with the vehicle at all times, and whoever is driving has a legal duty to follow the directions laid out in the road map. And by creating this vehicle, we’re allowed to drive right past the probate court on the way to our destination.

Of course, The Living Trust as a Vehicle ℠ is only a starting point for discussion. Most importantly, though, it helps our clients overcome their confusion and get moving on their planning process. If you’re ready to do the same, contact our team today.